Shopper Experience

07 April 2022

Machine learning meets the fitting room

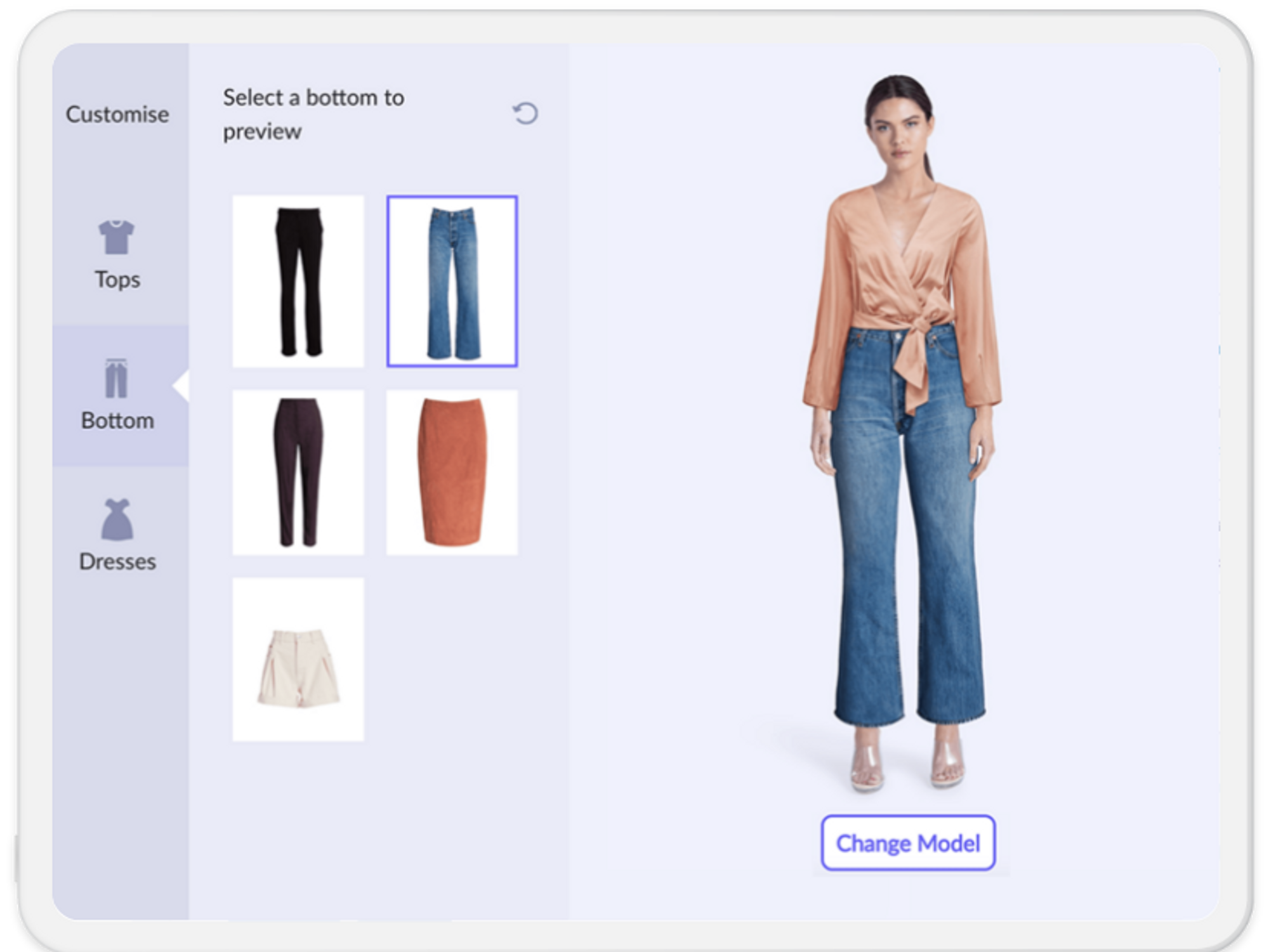

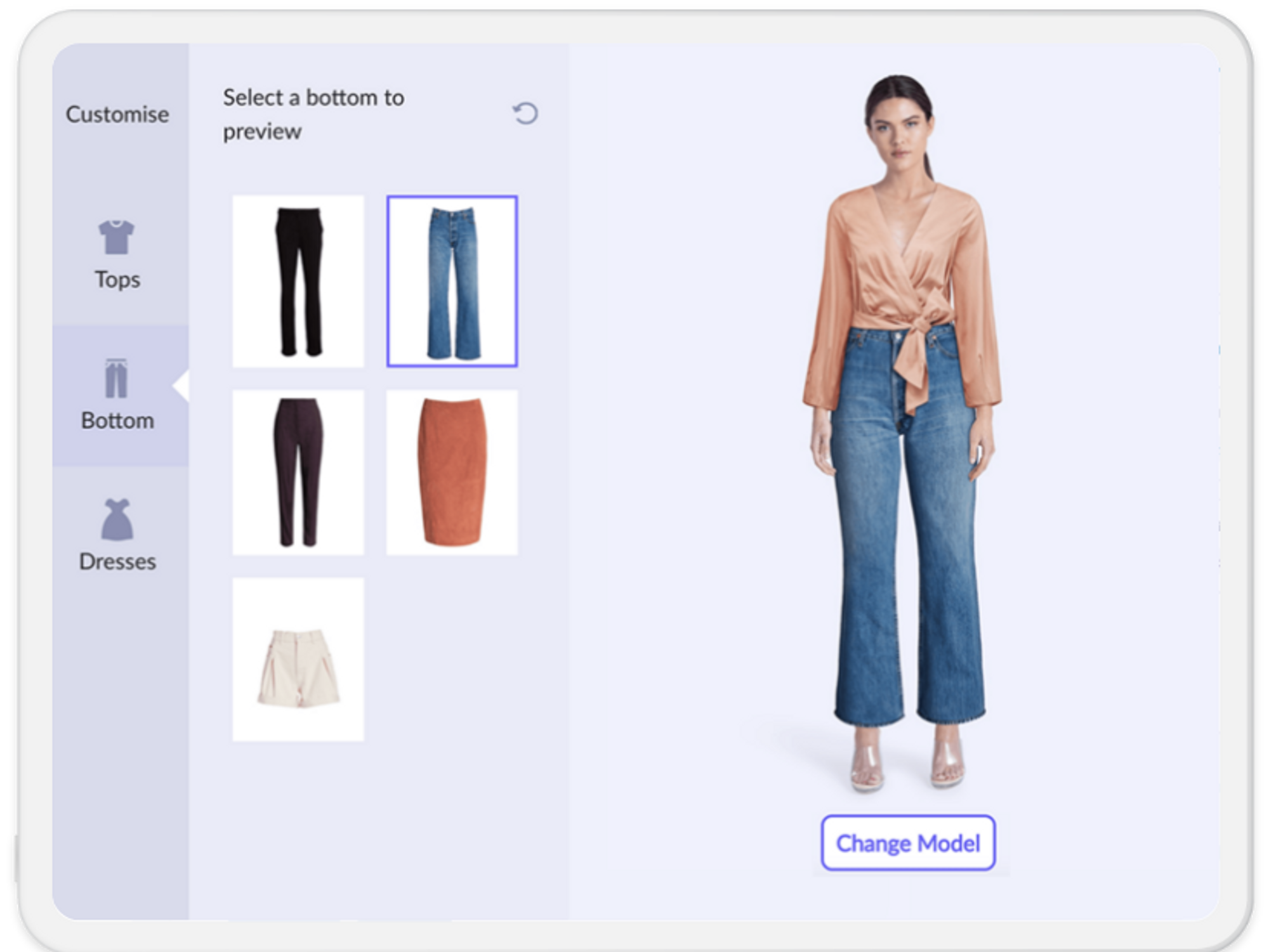

Vue.ai's virtual dressing room allows shoppers to size up looks and styles before they buy.

A look at Vue.ai's virtual dressing room software. (Courtesy photo)

Vue.ai's virtual dressing room allows shoppers to size up looks and styles before they buy.

A look at Vue.ai's virtual dressing room software. (Courtesy photo)

For shoppers deciding whether to buy, there’s nothing quite like knowing a product is the right look and fit. It may look good and be well-made, but getting to yes often requires seeing oneself in it.

In apparel and fashion, it's why the dressing room is an important part of the shopping experience. One of the many innovations to arrive in the 19th century with the rise of department stores, it offers a bridge between the public, stylized setting of the store, and the personal, every day space where the buyer will ultimately use the product.

The rise of ecommerce ushered in an era in which many key elements of the shopper experience was reinvented with tools that made it easier to find products, and make a purchase from anywhere that had internet access. A focus on simplicity and speed meant some elements of the in-store experience didn’t survive, but the dressing room is proving to have staying power. When the COVID-19 pandemic forced many fitting rooms to close for health and safety, it offered additional incentive for retailers to offer a version of the dressing room in digital form.

This is leading technologists to develop fitting room tools for a new generation of shopping experience.

Vue.ai applies artificial intelligence to its work with brands and retailers in the areas of personalization, search and imagery. Some of its customers include thredUP, DIESEL, Off-White and Centric Brands.

A virtual dressing room is prominent among the capabilities it offers. Drawing on a brand's products and images of models, the company’s virtual dressing room tool allows users to select a model that looks like them, and style it with products they are considering. Think of it as an AI-powered version of those day-at-the-mall montages from movies.

Embedded within a product development page, the virtual dressing room allows shoppers to see how products look on someone that is a similar look and size to themselves, and swap outfits.

“Having somebody that looks very similar to you can give you a lot of information about that product that you wouldn’t normally have,” said Brian Harris, Vue.ai Director of R&D and New Initiatives.

Using machine learning frameworks called Generative Adversarial Networks, the technology is designed so that shoppers can select across a range of different outfits and sizes. Yet it goes deeper than showing the difference between small and large, or shirt and pants. The technology understands silhouette, the type of sleeve, neckline and design elements. It also understands body parts, shape, musculature and skin tone. This can quickly add up to a number of options, but the technology is designed to sort that out, and is trained to provide exactly what shoppers request, Harris said.

“The number of possible combinations that you can create rapidly becomes millions within just a couple of product variations,” Harris said. “We provide the access to be able to do any of that with that accuracy without having to worry about something coming out as an inaccurately represented product.”

For brands and retailers, the dressing room can help increase conversion. An often-quoted statistic in retail indicates that customers who use an in-person fitting room are 70% more likely to buy a product than those who don’t. So the logic follows that this would also apply in the digital space. Fitting rooms can also boost retention and cut down on returns, said Harris.

For shoppers, the tool serves as a stylist of sorts, swapping out not only combinations of products, but also the models. For Vue.ai, a big focus is on being inclusive of all shoppers.

“Being able to represent size inclusion as well as ethnicity inclusion is really important in the marketplace, Harris said, adding that it’s important “to show models that look like the shopper and give a good idea of what this product might actually look like on [them].”

When shoppers see themselves represented, they can see themselves in a product.

Labor disputes on the West Coast could cause further disruption heading into peak season.

When the first half of 2023 is complete, imports are expected to dip 22% below last year.

That’s according to new data from the Global Port Tracker, which is compiled monthly by the National Retail Federation and Hackett Associates.

The decline has been building over the entire year, as imports dipped in the winter. With the spring, volume started to rebound. In April, the major ports handled 1.78 million Twenty-Foot Equivalent Units. That was an increase of 9.6% from March. Still it was a decline of 21.3% year over year – reflecting the record cargo hauled in over the spike in consumer demand of 2021 and the inventory glut 2022.

In 2023, consumer spending is remaining resilient with in a strong job market, despite the collision of inflation and interest rates. The economy remains different from pre-pandemic days, but shipping volumes are beginning to once again resemble the time before COVID-19.

“Economists and shipping lines increasingly wonder why the decline in container import demand is so much at odds with continuous growth in consumer demand,” said Hackett Associates Founder Ben Hackett, in a statement. “Import container shipments have returned the pre-pandemic levels seen in 2019 and appear likely to stay there for a while.”

Retailers and logistics professionals alike are looking to the second half of the year for a potential upswing. Peak shipping season occurs in the summer, which is in preparation for peak shopping season over the holidays.

Yet disruption could occur on the West Coast if labor issues can’t be settled. This week, ports from Los Angeles to Seattle reported closures and slowdowns as ongoing union disputes boil over, CNBC reported. NRF called on the Biden administration to intervene.

“Cargo volume is lower than last year but retailers are entering the busiest shipping season of the year bringing in holiday merchandise. The last thing retailers and other shippers need is ongoing disruption at the ports,” aid NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “If labor and management can’t reach agreement and operate smoothly and efficiently, retailers will have no choice but to continue to take their cargo to East Coast and Gulf Coast gateways. We continue to urge the administration to step in and help the parties reach an agreement and end the disruptions so operations can return to normal. We’ve had enough unavoidable supply chain issues the past two years. This is not the time for one that can be avoided.”