Solo Brands is a digitally native DTC platform that operates four outdoor lifestyle brands. After launch, the company grew quickly through rapid adoption of their primary product, the Solo Stove. Spencer Jan launched the brand in 2010 using $15,000, premiering his invention of necessity as their only product. Spencer grew up in Canada as an avid camper and self-described tinkerer. He came up with the idea after realizing the need for a small and lightweight stove that could be portable for easier (and warmer) camping trips. Solo’s lineup of outdoor oriented offerings was expanded significantly in 2021 as they acquired three brands across kayaking, paddle boarding and outdoor apparel. They also completed their IPO in late 2021, going public at $17.00 per share while raising $219 million. The initial market capitalization at IPO was $2.1B, but is now fallen to $400 million.

Earlier this year Solo Brands founder Spencer Jan detailed his full backstory for Practical Ecommerce, mentioning his first Solo equity exit in 2019 when a portion of his stake was sold to a private equity entity and he subsequently became a non-executive board member. Jan sold significantly more equity in 2020 at a much higher valuation and left the board as the company was primarily owned by two PE groups by that time. The private equity owners installed current CEO John Merris and pursued the classic buy and build private equity strategy, spending nearly $200 million acquiring three additional brands prior to the IPO:

- Oru Kayak in May 2021, $25.4 Million May 2021

- International Surf Ventures (ISLE) $24.8 Million, August 2021 (Paddleboards Brand)

- Chubbies $129.5 Million, in September 2021 (Outdoor Clothing)

Solo product line. (Courtesy image)

Solo product line. (Courtesy image)

The original filing of the IPO’s S-1 was detailed in a Bainbridge profile last year, primarily focusing on the company’s strong gross margins and relatively low customer acquisition costs. Also detailed in their S-1 was that a notable 92% of FY2020 revenue was from fire pits (Solo Stoves). This is a key statistic as there is minimal visibility of their product mix beyond that point, as the IPO occurred before the newly acquired businesses were fully integrated into the company. The 2021 acquisitions brought the total number of employees from 140 up to 220, but the company does not disclose performance of these brands (other multi-brand companies in the index disclose their brands revenues mix & growth). At this point in time it is difficult to discern what growth is purely acquisition driven and what brands are doing well. The company disclosed no information on average order value or active customers, only that they have a four million strong customer base.

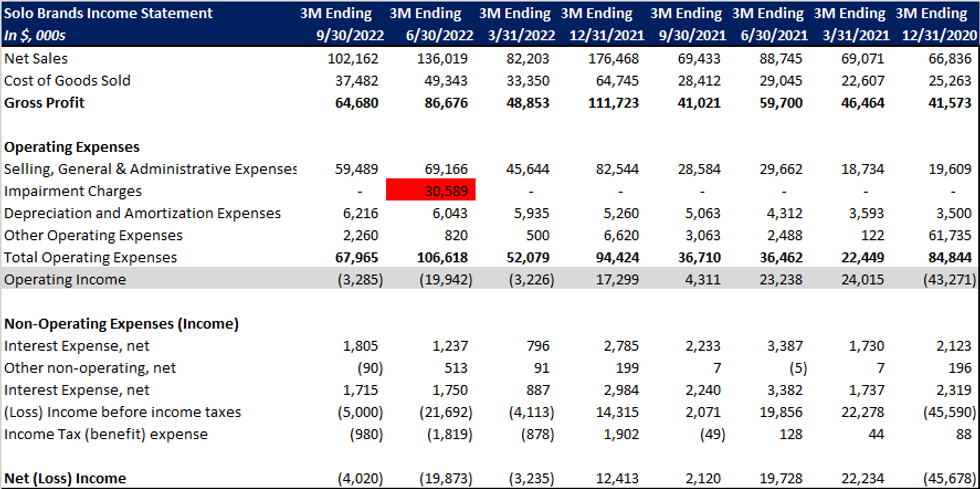

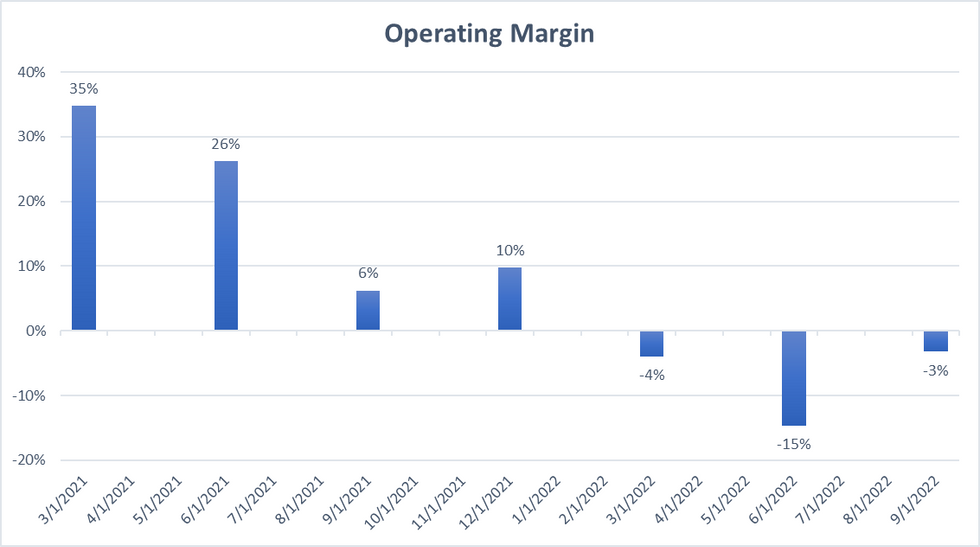

If you were to only examine the income statement, things look pretty good. Revenue in the most recent quarter was $102.1M, up 47% year-over-year. Gross margin has remained steady in the last several quarters in the low to mid 60s range. Looking further down the P&L is where some concerns appear. Operating margins have steadily deteriorated over the last 8 quarters, and Q2 2022 saw a significant impairment charge as the stock declined. While some other DTC brands have taken impairments recently, this one is nearly 10% of market capitalization and will drive a substantial net loss for the full year, while still leaving $380 million in goodwill on their balance sheet after the Q2 writedown.

Solo financial statements. (Courtesy image)

Solo financial statements. (Courtesy image)

Management now points to their organic growth, a result of expanding their product line within the Solo brand family. They have launched several items in the most recent quarter: Tower, Pie, Surround and Mesa. Most of the leadership's focus on the earnings call centered around Mesa and Pie. Mesa is their first product introduced with a price point below $100. They see this as an entry level offering that will increase the total addressable market and add B2B customers looking for bulk ordered customizable gifts. Pie was also heavily touted with its great reviews and was made Oprah’s “Best for the Holidays” 2022 list. Retail partnerships have also been a focus as they’ve begun wholesale agreements for their Chubbies brand with Dick’s Sporting Goods and Solo Stoves at Costco. The company is currently at 85% and 15% in terms of mix between DTC & wholesale but would like to get to 80/20 over the next few years.

Solo operating margin. (Courtesy of Solo)

Solo operating margin. (Courtesy of Solo)

Going forward, Solo needs to drive more synergies from their business model. Can Solo retain its genuine appeal while broadening its product line and drive efficient customer acquisition across its product lines? Or will it become a conglomerate of mostly unrelated products?

Solo product line. (Courtesy image)

Solo product line. (Courtesy image) Solo financial statements. (Courtesy image)

Solo financial statements. (Courtesy image) Solo operating margin. (Courtesy of Solo)

Solo operating margin. (Courtesy of Solo)