Shopper Experience

29 April 2022

AR shopping is about to get even bigger on Snapchat

Snap's latest tools enable brands and users to curate augmented reality experiences.

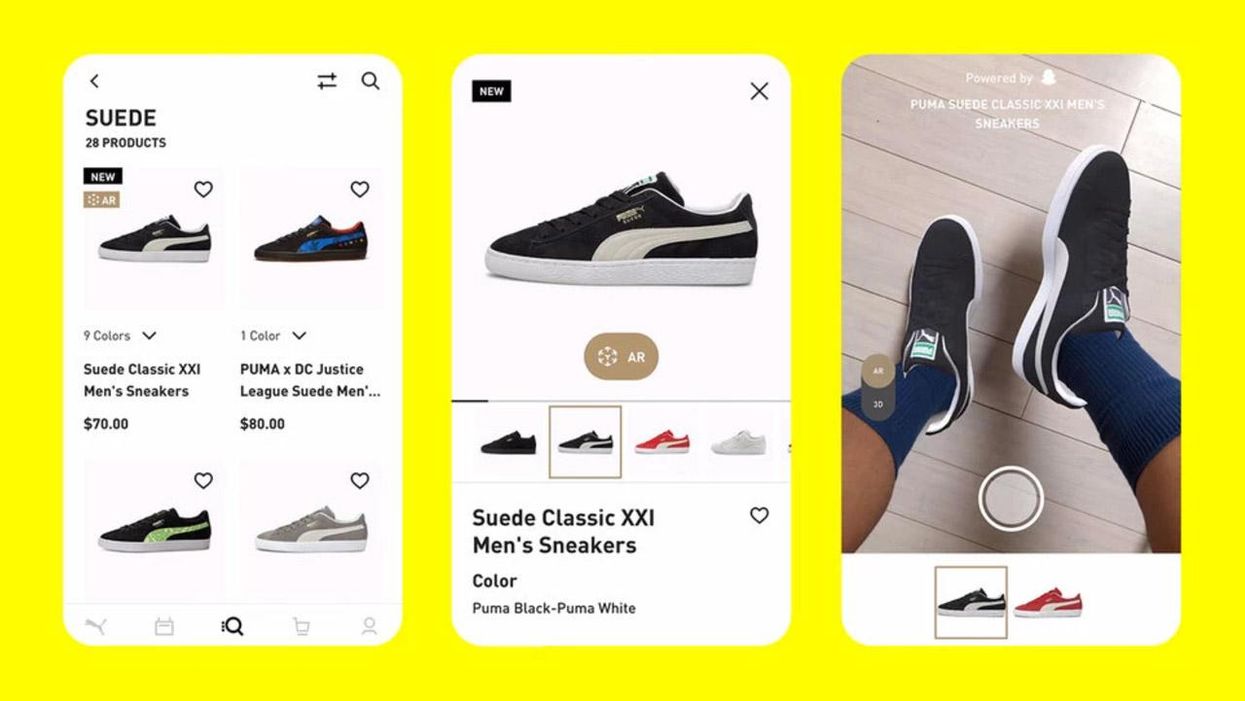

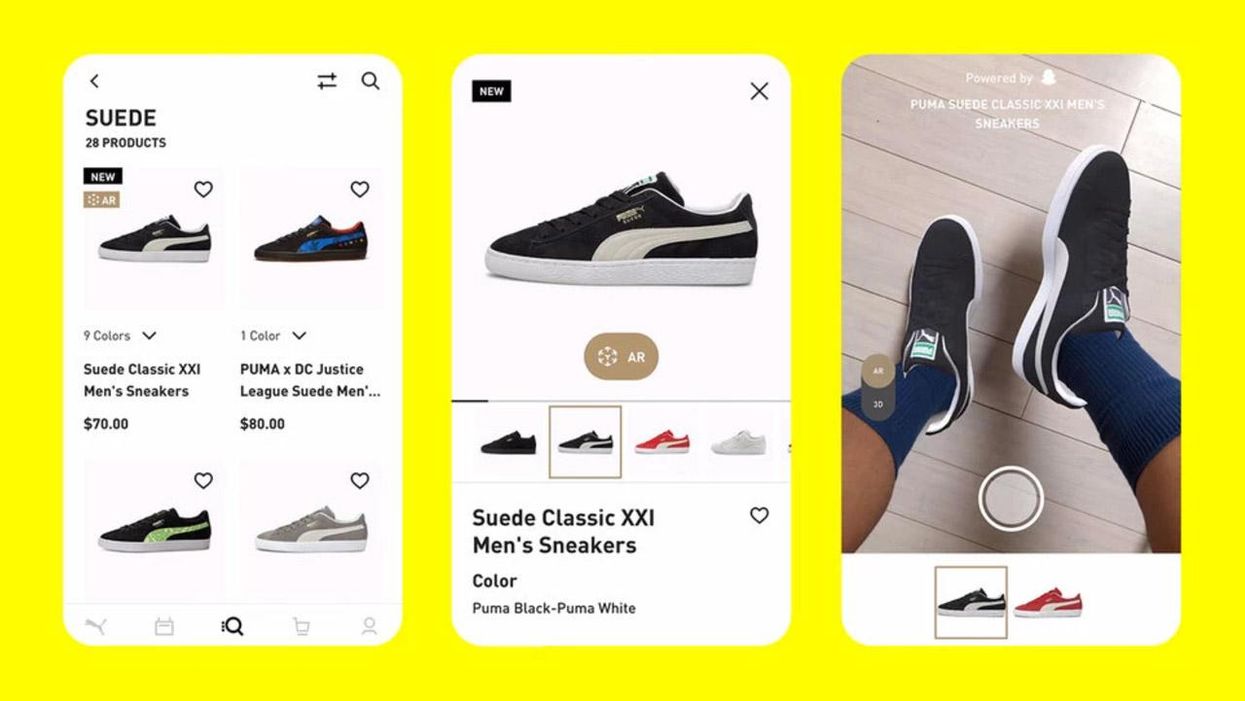

Puma is an early adopter of Snap's Camera Kit. (Photo by Snap)

Snap's latest tools enable brands and users to curate augmented reality experiences.

Puma is an early adopter of Snap's Camera Kit. (Photo by Snap)

Snap is rolling out a new line of tools designed to bring more products into augmented reality.

At the Snap Partner Summit on Thursday, shopping tools for Snapchat played a prominent role in the new announcements made by the Los Angeles-based company.

Snapchat’s camera capabilities have long made the social media platform a leader in augmented reality. In turn, the company is leveraging AR to grow shopping features, offering the equivalent of a mirror at the mall in social media form. One milestone came earlier this year, when it rolled out tools such as AR Shopping Lenses that allow users to get a taste of what they would look like in a brand's items through images of products superimposed on their likeness. With a big audience on the platform and cameras built-in, it's at the forefront of platforms transforming the try-on, and making social media more shoppable in the meantime.

With this week’s launch, it has a new slate of tools that allow brands and retailers to add to the available items and create new augmented reality experiences, both on Snapchat and, with one feature, within their own ecommerce marketplaces. Here’s a quick rundown:

Snap has a new home for augmented reality shopping for users within its app. Dress Up offers a dedicated destination to browse and try on looks from brands, retailers and creators. This is currently available through Lens Explorer, and will soon appear near the camera in navigation. Snap is also creating space for shopping on its profile pages, where users can return to looks they have favorited or added to a cart.

This is a web content management platform that allows businesses to “request, approve and optimize” 3D models for any product in their shopping catalog, Snap states. This feature also has sharing capabilities that allow retailers and brands to approve 3D models from other brands that are already in Snap’s asset management system.

This technology, developed by Forma, offers a way to turn existing product photos into augmented reality-read assets for Snapchat’s Lens experience. Snap describes the steps like this:

Step 1: Partners upload their existing product photography for product SKUs they currently sell on their websites.

Step 2: Product photography is processed with a deep-learning module that transforms retailer’s photography into AR Image assets.

Step 3: Businesses can then select SKUs with AR Image Assets to create try-on Lenses using new templates in a simple web interface.

Now in beta, this feature is designed to allow brands to import assets and create AR experiences, without having any prior AR skills. It expands a capability that was previously available for beauty brands to apparel, eyewear and footwear. Snap will also expand into furniture and handbags, allowing items in AR to be placed on a surface.

This software development kit allows brands and retailers to bring Snap’s AR try-on capabilities to their product detail pages. Available for mobile devices and soon on websites, Puma will be the first brand to use this tool to integrate its Snap experience on to its own website.

Labor disputes on the West Coast could cause further disruption heading into peak season.

When the first half of 2023 is complete, imports are expected to dip 22% below last year.

That’s according to new data from the Global Port Tracker, which is compiled monthly by the National Retail Federation and Hackett Associates.

The decline has been building over the entire year, as imports dipped in the winter. With the spring, volume started to rebound. In April, the major ports handled 1.78 million Twenty-Foot Equivalent Units. That was an increase of 9.6% from March. Still it was a decline of 21.3% year over year – reflecting the record cargo hauled in over the spike in consumer demand of 2021 and the inventory glut 2022.

In 2023, consumer spending is remaining resilient with in a strong job market, despite the collision of inflation and interest rates. The economy remains different from pre-pandemic days, but shipping volumes are beginning to once again resemble the time before COVID-19.

“Economists and shipping lines increasingly wonder why the decline in container import demand is so much at odds with continuous growth in consumer demand,” said Hackett Associates Founder Ben Hackett, in a statement. “Import container shipments have returned the pre-pandemic levels seen in 2019 and appear likely to stay there for a while.”

Retailers and logistics professionals alike are looking to the second half of the year for a potential upswing. Peak shipping season occurs in the summer, which is in preparation for peak shopping season over the holidays.

Yet disruption could occur on the West Coast if labor issues can’t be settled. This week, ports from Los Angeles to Seattle reported closures and slowdowns as ongoing union disputes boil over, CNBC reported. NRF called on the Biden administration to intervene.

“Cargo volume is lower than last year but retailers are entering the busiest shipping season of the year bringing in holiday merchandise. The last thing retailers and other shippers need is ongoing disruption at the ports,” aid NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “If labor and management can’t reach agreement and operate smoothly and efficiently, retailers will have no choice but to continue to take their cargo to East Coast and Gulf Coast gateways. We continue to urge the administration to step in and help the parties reach an agreement and end the disruptions so operations can return to normal. We’ve had enough unavoidable supply chain issues the past two years. This is not the time for one that can be avoided.”