Marketing

23 February 2023

Instacart rolls out display ads, remote smart cart management

The tech company has new features designed for independent grocers.

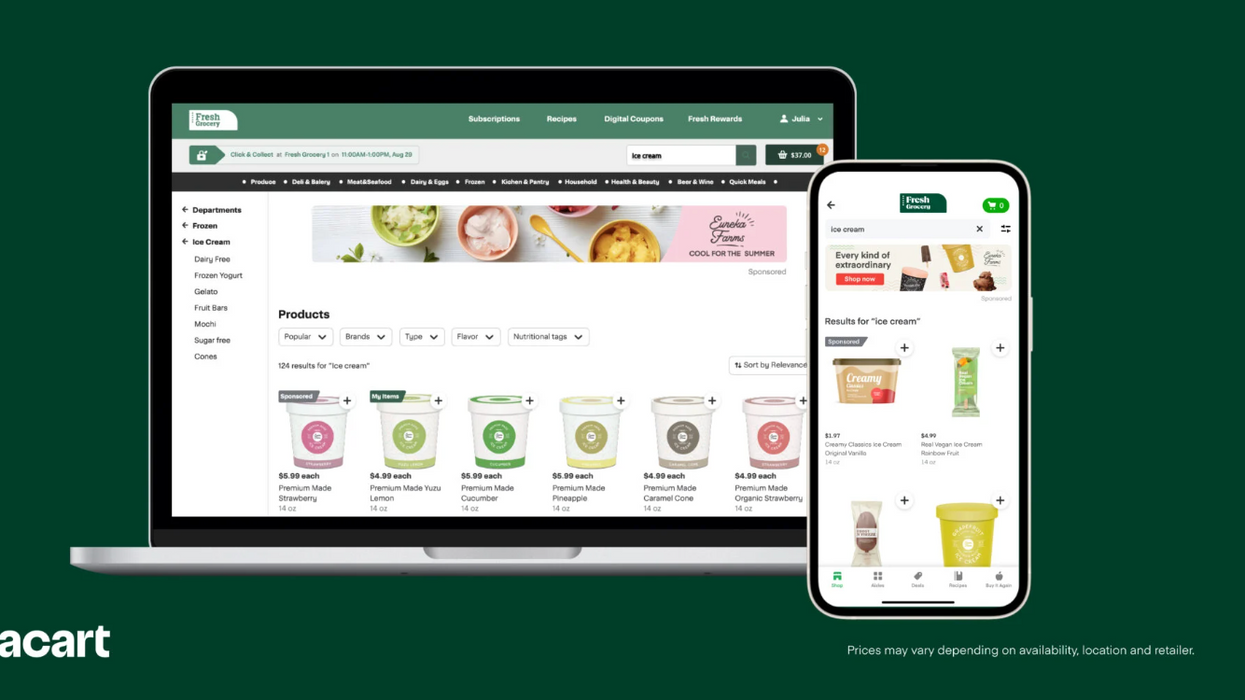

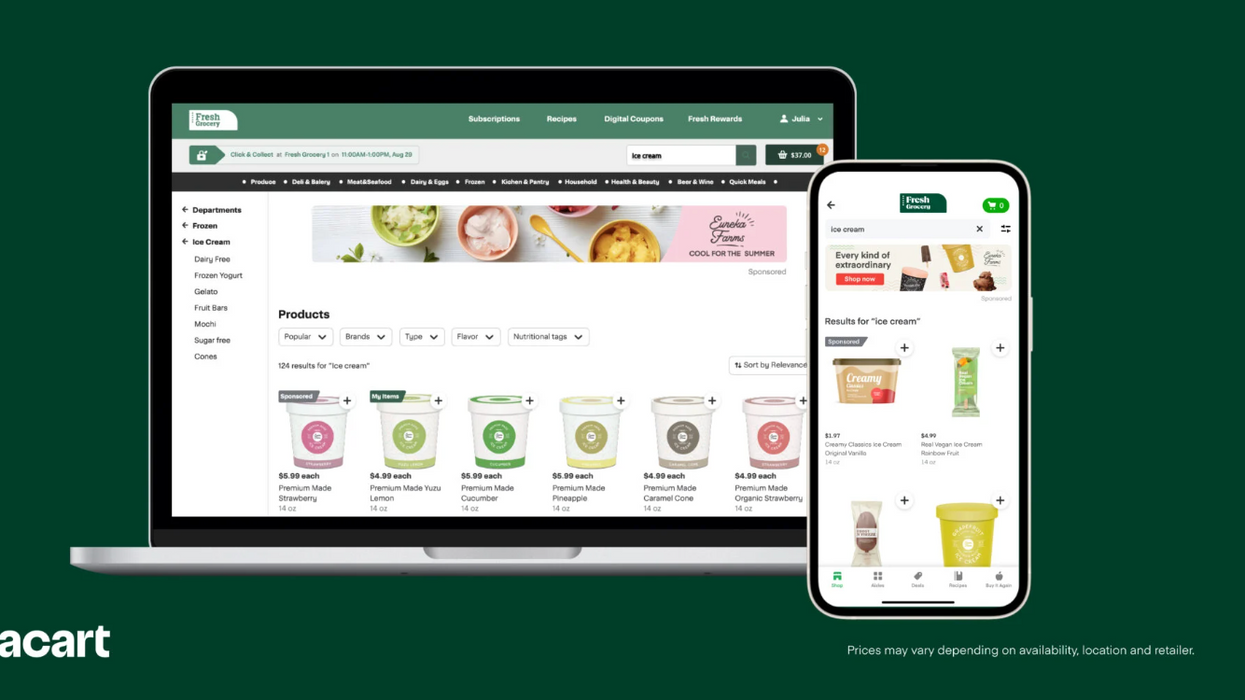

Instacart display ads. (Courtesy photo)

The tech company has new features designed for independent grocers.

Instacart display ads. (Courtesy photo)

Instacart is rolling out a series of new features that are designed to help grocers grow digital commerce capabilities. The features are being added to Instacart Platform, which was launched by the company last year to provide new tools for grocers that go beyond Instacart’s initial use for delivery.

The new features are:

Display ads. Instacart provides tools for grocers to set up retail media on their ecommerce sites. Now, these products will include display ads alongside existing sponsored products. With these ads, CPG brands can display banners that “raise awareness and consideration of products, helping to drive bigger baskets for grocers,” Instacart said.

Sold by weight. FoodStorm, which is Instacart’s order management system, will now support items to be sold by weight. This is designed to enable digital ordering of fresh food, deli items and specialty items. In turn, grocers will be able to offer delivery of these items from a single platform.

Remote smart cart management. Instacart’s smart cart, called Caper Carts, can now be managed remotely via tablet. This is designed to provide a “birdseye view” of stores for grocers, offering information about how many carts are being used and what types of items are being shopped. Grocers can also flag items for audit.

Fulfillment for independent grocers. Last year, Instacart acquired independent grocer-focused ecommerce platform Rosie. Now, it is leveraging the technology to offer whitelabel ecommerce technology for local and independent grocers. Now, these grocers can tap Instacart’s fulfillment teams to pick, pack and deliver orders. It adds a new service on top of online storefronts, web page creation and customer support.

Key quote from Instacart GM of local independent grocer Nick Nickitas: “Instacart is building technology to invest in the future of our retail partners, and we believe that local and independent grocers in particular can benefit from easy, affordable solutions that are built just for them. We put your store in the palms of your customers’ hands so you can meet them where and how they want to shop.”

Instacart said its platform is being used by grocers such as The Fresh Market, New Seasons Market, Uncle Giuseppe’s Marketplace, Niemann Foods and Associated Food Stores.

These features are being rolled out as Instacart gets set to appear next week at the National Grocers Association (NGA) annual gathering. The company will have a booth, and executives will be among the featured speakers.

New advertising opportunities are being beta tested for in-store audio and product demos.

Retail media’s fast growth isn’t only limited to increasing spend. The advertising itself is also poised to appear in more places beyond ecommerce marketplaces, and even beyond the web.

The latest example comes from Walmart Connect, which is the retail media arm of the world’s largest retailer.

Walmart shared details on testing that it is completing for in-store retail media. To this point, Walmart Connect has been considered the advertising platform for Walmart’s ecommerce site. But these tests indicate that’s poised to expand.

Stores present a potent opportunity for Walmart. It has 4,700 big box locations around the U.S., and customers returned to them in droves last year. In 2022, 88% of the retailer’s customers visited Walmart stores.

Walmart Connect already has already dipped a toe into in-store advertising, with a TV wall, self-checkout ads and integrated marketing. The new pilots aim to take a step further.

“The next frontier of retail media is in-store experiences, and it’s one we’re excited to chart,” Whitney Cooper, head of omnichannel transformation at Walmart Connect, wrote in a blog post on the new tests. “But it’s still an emerging opportunity for us, as we continue to test what serves customers best and which solutions are scalable to Walmart’s size.”

Here’s a look at the two new offerings currently under beta test:

Walmart suppliers will be able to integrate product demos into campaigns across in-store and digital environments.

Product demos aren’t new to store floors, but Walmart Connect is seeking to give them an update that blends digital and physical experiences.

“Part of our test is how to enhance the omnichannel experience by bridging the physical back to digital: For example, by pairing a demo cart with QR codes that link back to a curated Walmart.com landing page so customers can find inspiration and shop their list all in one spot,” Cooper wrote.

Walmart is currently offering 120 demos at stores each weekend, and plans to scale to 1,000 by the end of 2023.

Walmart Connect will now offer advertising placements on Walmart’s in-store radio network. Suppliers will have the option to purchase ads by region or store, enabling targeting of key markets.

“This is the first time brands will be able to speak directly to Walmart customers through this medium,” Cooper writes. “These ads also create a new upper-funnel touchpoint for brand marketers and out-of-home (OOH) buyers to create awareness, because in-store audio is about connecting with customers wherever they are in the store — they don’t have to pass the brand in the aisle.”

With the tests, we’ll be watching for how this advertising is measured, and whether Walmart Connect is tracking impact across different types of formats, and not just a single campaign.