Beauty starts on the inside.

The old adage has long helped to inspire confidence, and new outlooks. For Carolyn Yachanin, the recognition that healing can start from within led to the creation of a new brand in 2020. Now, Copina Co. is expanding to Amazon and growing a presence in retail outlets as its product line continues to evolve.

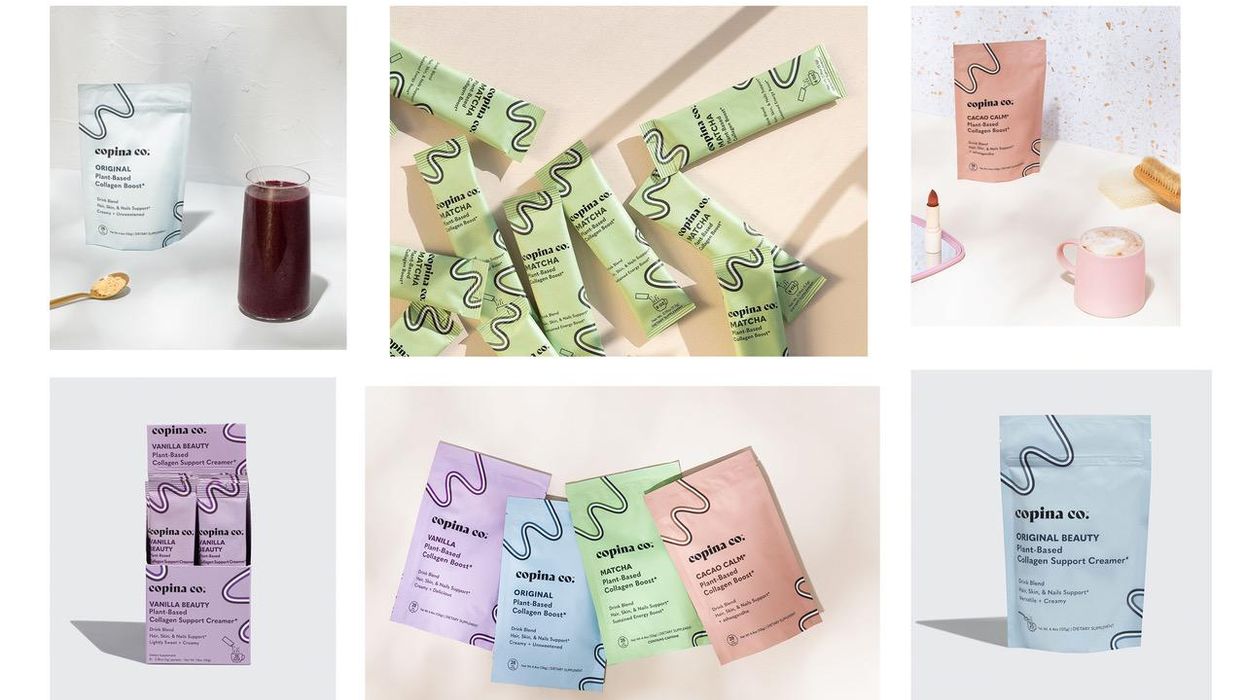

Copina Co. offers vegan drink blends that support the production of collagen, which is an important protein to boost energy, as well as the strength of hair, skin and nails. The brand makes edible products that find a home in the beauty aisle, and in turn promote health.

As is the case with many entrepreneurial ventures, the brand grew out of the founder’s own search for a better product.

“My personal health journey and eventual healing with holistic medicine inspired me to found Copina Co.,” Yachanin said. “I started my business because I fundamentally believe that the focus of beauty needs to be on internal health. Years of harsh acne treatments like oral antibiotics and two rounds of commonly prescribed medication left my skin dry and depleted and my gut health in shambles. I turned to holistic and herbal medicine out of a search for something better, and it changed my life.”

Recognizing the power of plants to heal from within, Yachanin was inspired to bring a fundamentally new product to the wellness space: An edible beauty product that centers internal health as the “building block of beauty,” Yachanin said.

“I started Copina Co. out of my apartment in 2020 and worked with holistic health professionals to create my products from scratch,” Yachanin said. “Copina Co. brings the power of nature's best plant botanicals to all in delicious, easy-to-use, and effective blends.”

The brand now has a variety of powder supplements, all of which are formulated by herbalists. Harnessing plants to support collagen production, flavors include Matcha, Cacao Calm and Vanilla. The brand’s products are non-GMO and sugar-free. Yachanin said they fit right in with a morning coffee, smoothie or latte, as well as an evening hot cocoa.

Alongside sales from its direct-to-consumer website, the brand has grown a presence at retailers that put a focus on nutrition and wellness. This has helped Copina Co. gain a foothold with consumers who are interested in new approaches to health, just like Yachanin was when she started the brand.

“We expanded into a select few retailers like Erewhon very early on because we understood the important role that they play,” Yachanin said. “Key retailers like the ones that we work with do an incredible job at curation, community building, and customer education. They gave us the opportunity to meet people where they were already shopping and introduce them to Copina Co. in a way that felt natural and on-brand. We've worked hand-in-hand with the amazing store teams on the ground at our retail partners that do an amazing job with customers’ nutrition education.”

It has since expanded into Mother's Markets, Juice Press, Earthbar, Jimbo's and more.

More channels are being added this fall. In September, Copina Co. debuted on Amazon. By the end of October, the products are expected to be on shelves at select Whole Foods locations.

“Launching at Whole Foods and Amazon both represent amazing opportunities for us not just because they're amazing companies, but also because they're integral parts of where the modern US wellness consumer shops,” Yachanin said. “Being present on their shelves and online stores allows us to reach more people, tell our story in a way that feels authentic to our brand, and helps us with brand discovery and product trial.”

As it has grown, the brand has also listened closely to consumers to determine where it can grow its product offerings. That applies not only to flavors, but also the sizes and shapes in which it is delivered. One result of this is also arriving this fall in the form a new packaging option to try out the product: single-serve sticks.

“The single serve stick packs got started after we launched at retail and realized that customers wanted a cost-effective way to sample the product before committing to a 25-serving pouch purchase,” Yachanin said. “The stick packs allow customers to get an introduction to our brand in this way. Both our in-store and online customers love them because they're so travel-friendly and make it easy to bring your daily wellness rituals on-the-go.”

Copina Co. is one of a number of emerging brands that is finding growth through retail partnerships. Digitally native brands are showing up on more shelves as they innovate not only in go-to-market strategies, but also in the products they offer. For Copina Co., this expansion has been the result of considering retailers where it can meet the customers that are most likely to buy its products, and where its focus on wellness is a good fit.

The brand's expansion this fall comes as holiday shopping gets underway. The high season for retailers is a time when people consider new products that reflect their values, and look to give gifts to others that support their journeys.

“We're seeing customers looking to invest in their well-being more than ever,” Yachanin said. “Gifting has expanded to the wellness space. We see more and more people interested in giving the gift of wellness to themselves and their loved ones this season.”

Health and beauty products are often grouped together in retail. Copina Co. shows how the two sides of a category are coming together in one product, and finding space on more shelves.