Marketing

10 March 2023

Amazon leads in retail media, with nearly 40% market share

MediaRadar shares the top five brands spending on retail media.

Photo by Christian Wiediger on Unsplash

MediaRadar shares the top five brands spending on retail media.

Retail media has exploded in recent years, as the power of ecommerce marketplaces has presented opportunities for brands to reach consumers by advertising on the same platform where they shop and buy products.

During this expansion, retailers from Michaels to Best Buy to Kroger launched their own retail media networks to create avenues for brands to leverage first-party data that comes from sales and loyalty programs for advertising on marketplaces. Gradually, that data is also being used to advertise across the web, as well.

Now, a new market that crosses advertising and commerce is coming into view. In all, retail media is now worth an estimated $100 billion, according to a new study from advertising intelligence and sales enablement platform MediaRadar.

When it comes to the retail leaders in the space, findings from MediaRadar included the following:

Amazon is the dominant force in retail media, capturing 37% of market share. Over 14,200 companies advertised 17,000-plus brands on the online giant in 2022.

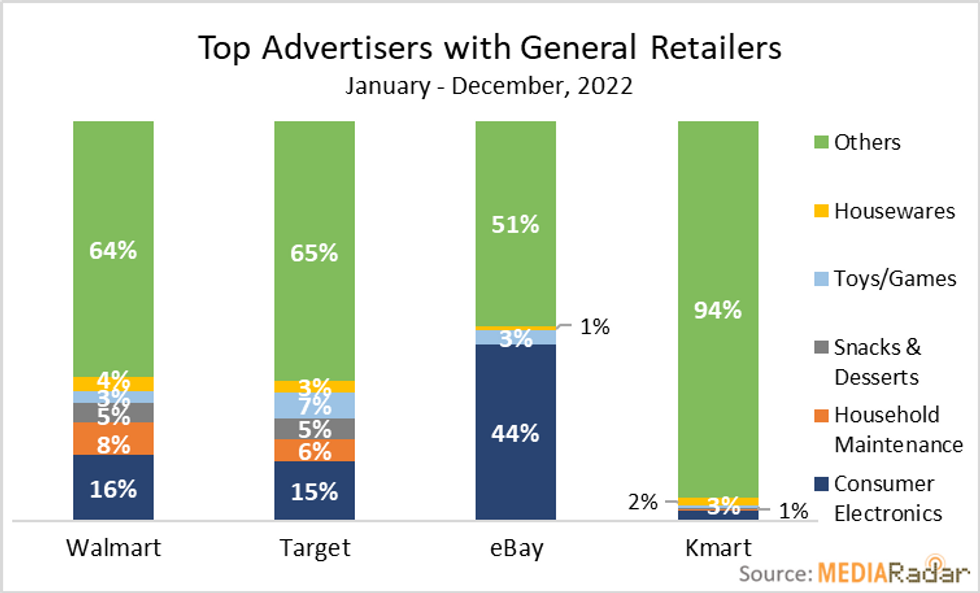

General/mass retailers, including Walmart and Target collectively captured 36% of ad spend in retail media.

That means the largest players in the space accounted for 73% of retail media ad investment in 2022.

Still, the gap between Amazon and the rest of the field is notable. Amazon reported having a $31 billion advertising business in early 2022, and growth only continued from there as it posted growth north of 20% in each quarter of the year.

Just as Amazon has the lead in ecommerce, it also has the lead in retail media. This makes the company not only a powerhouse in commerce, but also one of the largest digital advertising giants.

"Amazon has such a tight grip on the digital space that they really sit in a category of their own," said Todd Krizelman, CEO and cofounder of MediaRadar, in a statement. "Other players are growing quickly, but it will be difficult for legacy brick and mortar retailers to beat Amazon on its own terrain. Retailers should explore other opportunities to extend retail media - such as in-store digital experiences or other channels like email newsletters, where Amazon doesn't have as much traction."

When it comes to brand adoption of this channel, MediaRadar shared the following:

In all, nearly 26,000 companies advertised almost 40,000 brands across retail media networks.

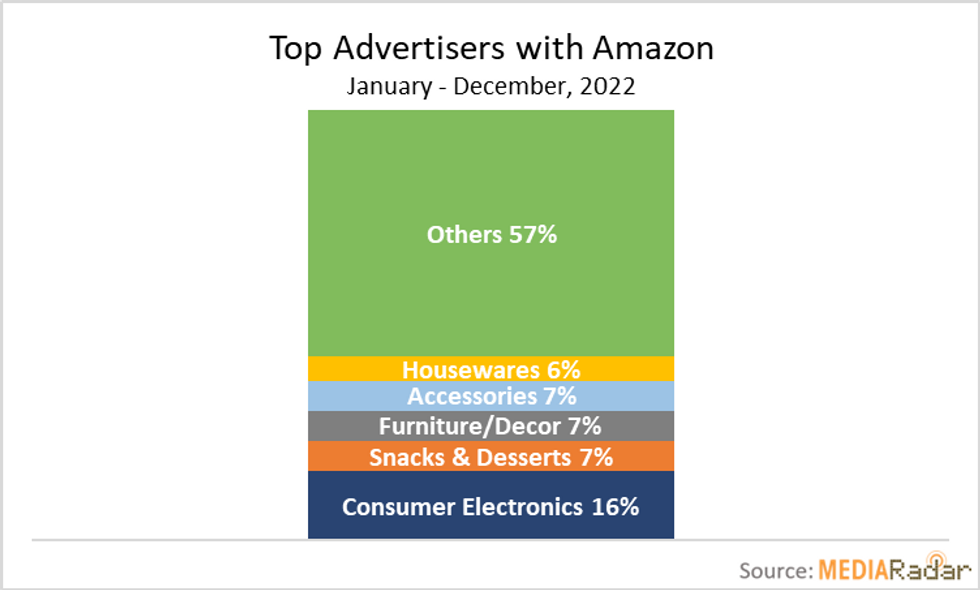

Top categories for retail media included consumer electronics (15% of spend), housewares (6%), snacks & desserts (6%), household maintenance products (5%), and furniture/decor (5%). This accounted for 37% of total retail ad spend last year.

The top five brands spending in retail media include HP, Palmolive, Pepperidge Farm, Planters, Ritz, Epson and Starbucks.

For brands, retail media is serving as a viable new advertising channel at a time when privacy-oriented shifts like Apple’s App Tracking Transparency and the coming demise of third-party cookies are making long-used tools for social media-based advertising less efficient than they once were.

"Brands are making a big push into retail media right now," said Krizelman. "This trend will only continue as more advertisers seek lower funnel channels to drive performance for their spend, and as identity-based advertising on the open web continues to decline. Retail media offers a solution to these issues."

New advertising opportunities are being beta tested for in-store audio and product demos.

Retail media’s fast growth isn’t only limited to increasing spend. The advertising itself is also poised to appear in more places beyond ecommerce marketplaces, and even beyond the web.

The latest example comes from Walmart Connect, which is the retail media arm of the world’s largest retailer.

Walmart shared details on testing that it is completing for in-store retail media. To this point, Walmart Connect has been considered the advertising platform for Walmart’s ecommerce site. But these tests indicate that’s poised to expand.

Stores present a potent opportunity for Walmart. It has 4,700 big box locations around the U.S., and customers returned to them in droves last year. In 2022, 88% of the retailer’s customers visited Walmart stores.

Walmart Connect already has already dipped a toe into in-store advertising, with a TV wall, self-checkout ads and integrated marketing. The new pilots aim to take a step further.

“The next frontier of retail media is in-store experiences, and it’s one we’re excited to chart,” Whitney Cooper, head of omnichannel transformation at Walmart Connect, wrote in a blog post on the new tests. “But it’s still an emerging opportunity for us, as we continue to test what serves customers best and which solutions are scalable to Walmart’s size.”

Here’s a look at the two new offerings currently under beta test:

Walmart suppliers will be able to integrate product demos into campaigns across in-store and digital environments.

Product demos aren’t new to store floors, but Walmart Connect is seeking to give them an update that blends digital and physical experiences.

“Part of our test is how to enhance the omnichannel experience by bridging the physical back to digital: For example, by pairing a demo cart with QR codes that link back to a curated Walmart.com landing page so customers can find inspiration and shop their list all in one spot,” Cooper wrote.

Walmart is currently offering 120 demos at stores each weekend, and plans to scale to 1,000 by the end of 2023.

Walmart Connect will now offer advertising placements on Walmart’s in-store radio network. Suppliers will have the option to purchase ads by region or store, enabling targeting of key markets.

“This is the first time brands will be able to speak directly to Walmart customers through this medium,” Cooper writes. “These ads also create a new upper-funnel touchpoint for brand marketers and out-of-home (OOH) buyers to create awareness, because in-store audio is about connecting with customers wherever they are in the store — they don’t have to pass the brand in the aisle.”

With the tests, we’ll be watching for how this advertising is measured, and whether Walmart Connect is tracking impact across different types of formats, and not just a single campaign.