Research

18 May 2022

Shoppers are returning to pre-pandemic habits

The Tradeswell InFORM Report provides data on consumer demand for the first quarter of 2022.

(Illustration by Tradeswell)

The Tradeswell InFORM Report provides data on consumer demand for the first quarter of 2022.

(Illustration by Tradeswell)

Welcome to Data File. In this weekly feature, The Current shares key findings shaping the ecommerce landscape. This week, we're sharing a section from Tradeswell's InFORM Report Q1 2022, which provides insights on ecommerce finance, operations, retail and marketing. Download the full report here.

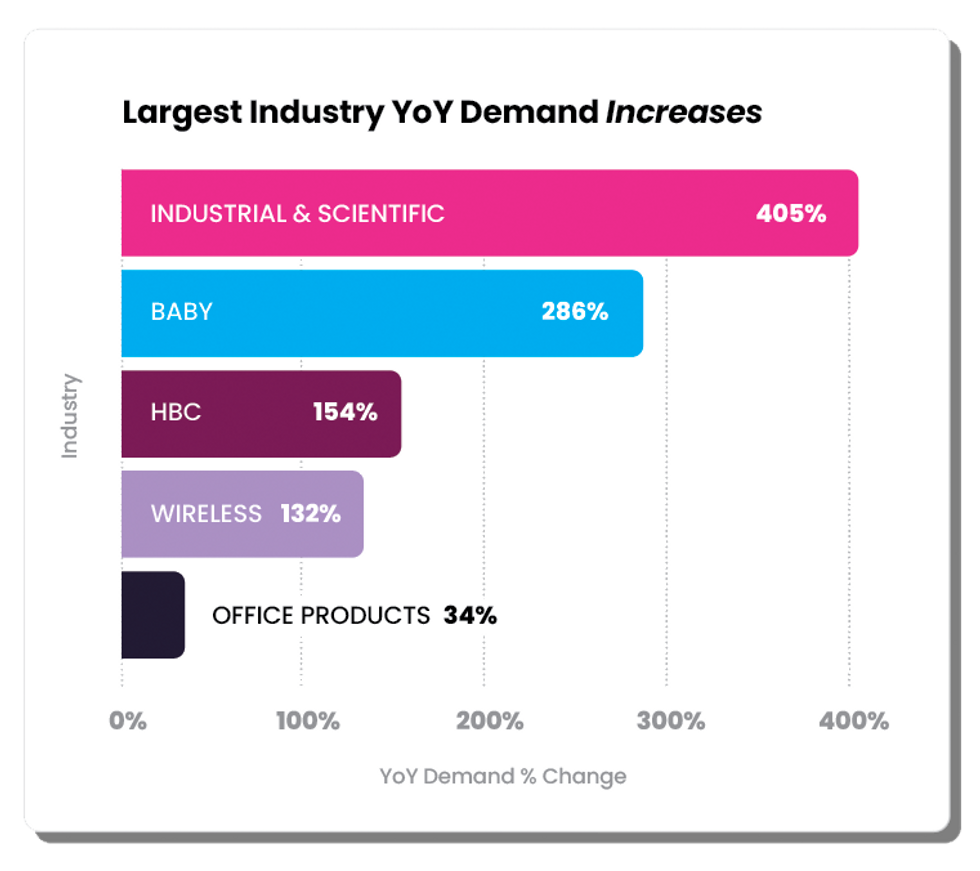

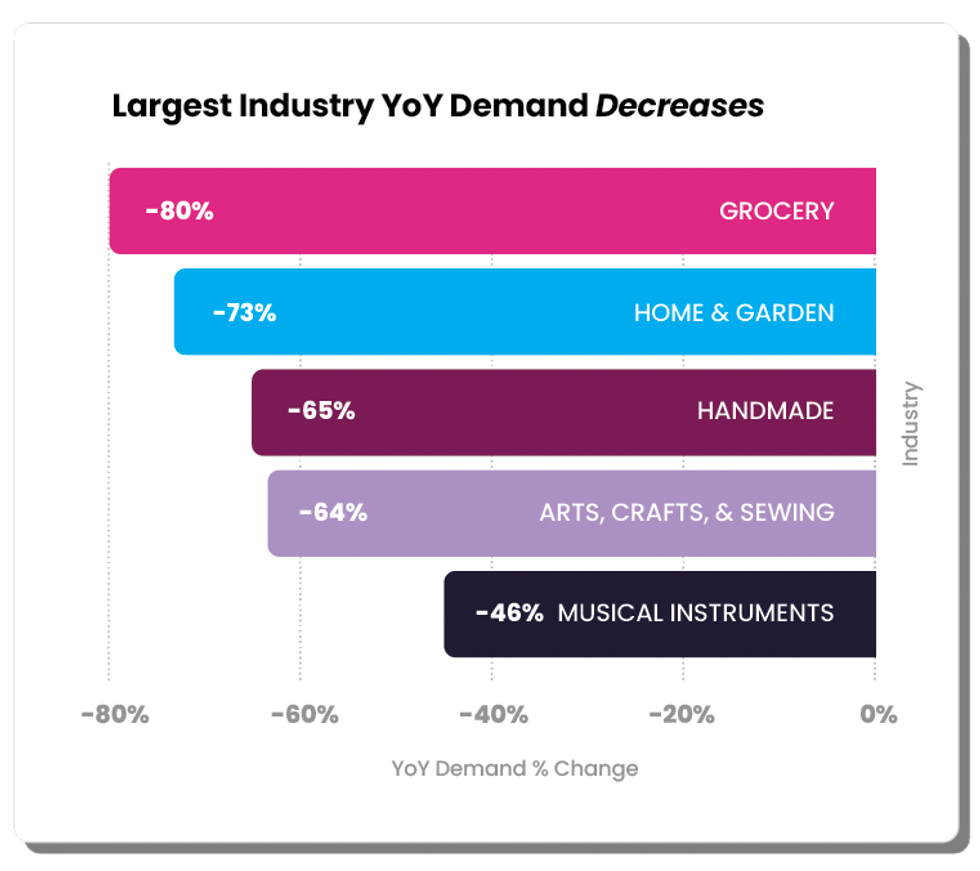

We broke down our consumer demand metric based on industries with the largest demand growth and decline. Investigating consumer demand trends allows you to understand how shoppers are shifting their buying habits, better predict sales, and make informed decisions around advertising and inventory.

Based on search term rankings and the volume of search terms, we identified the industries with the largest growth and decreases in consumer demand, along with how shopping trends are pivoting, as we emerge from the pandemic.

The Industrial and Scientific category, which includes rapid COVID tests and face masks, had the highest YoY growth rate from Q1 2021 to Q1 2022 at 405%. This correlates with COVID infection patterns. January 2022 saw the highest spike in COVID cases, likely causing the increased demand for tests and masks. Baby is another category that increased in consumer demand with a 286% increase in growth YoY in Q1 2022. Early in the pandemic, many experts believed there would be a baby boom with more people staying home. Instead, birth rates dropped in 2020. Based on our data and supporting outside research, we expect to see a rise in births in the coming year. Bank of America found that pregnancy test sales are up 13% YoY since 2020—a strong indication that there will be more births in 2022.

(Chart by Tradeswell)

With more people returning to offices, it comes as no surprise that sales of products in the Office Products category grew nearly 34% YoY in Q1 2022. According to a study by Microsoft, 50% of leaders say they already require or plan to require employees to return to in-person work full-time in the next year. Major companies, including Microsoft, Apple, Ford, and Wells Fargo, have all announced they will require employees to be back in the office on at least hybrid models—driving increased demand for office supplies.

(Chart by Tradeswell)

While many pandemic-driven online habits are here to stay, our findings suggest that shoppers are returning to physical stores for groceries.

Online consumer demand for groceries decreased 79% YoY. The availability of vaccines and drop in mask mandates have made shoppers feel more comfortable browsing for groceries in an aisle rather than from their couch. Another factor contributing to the drop in online grocery shopping is the increase in grocery prices due to the war in Ukraine. In-person shopping is less convenient, but it allows people to easily compare prices and products, and there’s no delivery and tip fee on top of the bill.

Remember when baking sourdough bread was all the rage? A survey by Lending Tree found that six out of ten Americans picked up a new hobby during the pandemic, but the return to pre-pandemic lifestyles has resulted in people abandoning these new activities. Arts, Crafts, and Sewing saw a 63% decline in consumer demand YoY, and Musical Instruments saw a 45% decline in consumer demand YoY. People are also spending less on Home and Garden products as they spend more time out of their homes.

Campbell Soup Company CEO Mark Clouse offered thoughts on messaging amid inflationary shifts in consumer behavior.

After months of elevated inflation and interest rate hikes that have the potential to cool demand, consumers are showing more signs of shifting behavior.

It’s showing up in retail sales data, but there’s also evidence in the observations of the brands responsible for grocery store staples.

The latest example came this week from Campbell Soup Company. CEO Mark Clouse told analysts that the consumer continues to be “resilient” despite continued price increases on food, but found that “consumers are beginning to feel that pressure” as time goes on.

This shows up in the categories they are buying. Overall, Clouse said Campbell sees a shift toward shelf-stable items, and away from more expensive prepared foods.

There is also change in when they make purchases. People are buying more at the beginning of the month. That’s because they are stretching paychecks as long as possible.

These shifts change how the company is communicating with consumers.

Clouse said the changes in behavior are an opportunity to “focus on value within our messaging without necessarily having to chase pricing all the way down.”

“No question that it's important that we protect affordability and that we make that relevant in the categories that we're in," Clouse said. "But I also think there's a lot of ways to frame value in different ways, right?”

A meal cooked with condensed soup may be cheaper than picking up a frozen item or ordering out. Consumers just need a reminder. Even within Campbell’s own portfolio, the company can elevate brands that have more value now, even if they may not always get the limelight.

The open question is whether the shift in behavior will begin to show up in the results of the companies that have raised prices. Campbell’s overall net sales grew 5% for the quarter ended April 30, while gross profit margins held steady around 30%. But the category-level results were more uneven. U.S. soup sales declined 11%, though the company said that was owed to comparisons with the quarter when supply chains reopened a year ago and expressed confidence that the category is seeing a longer-term resurgence as more people cook at home following the pandemic. Snacks, which includes Goldfish and Pepperidge Farm, were up 12% And while net sales increased overall, the amount of products people are buying is declining. Volumes were down 7%.

These are trends happening across the grocery store. Campbell is continuing to compete. It is leading with iconic brands, and a host of different ways to consume them. It is following that up with innovation that makes the products stand out. Then, it is driving home messaging that shows consumers how to fit the products into their lives, and even their tightening spending plans.

Campbell Soup is more than 150 years old, and has seen plenty of difficult economic environments. It is also a different business today, and will continue to evolve. At the end of the day, continued execution is what’s required.

“If it's good food, people are going to buy it, especially if it's a great value,” Clouse said.